BHARAT KA ONLINE SCHOOL

Class 9th-12th & Entrance Exam Online Tuition

Ab sikhen apni bhasha mein

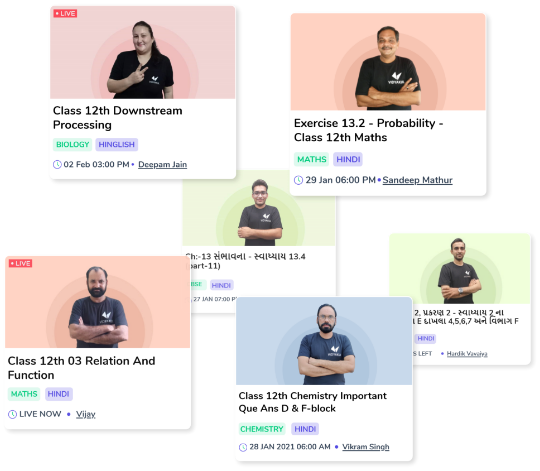

Free Live Classes

Feels like you are in the classroom

Learn and chat with expert faculties in interactive live classroom with limited students and also get your doubts cleared instantly during class.

Start Learning

Master Batches

NCERT & Top books live solutions

Get access to all our live and recorded structured courses in line with your exam syllabus to help you best prepare for it.

Start LearningSmart E-Books

Lots of e-book & handwritten notes, 100% free

1000's of e-books and handwritten notes prepared by expert faculties in local languages to boost your exam preparation.

Start Learning

Free Practice Tests

Test series, mock test & daily quiz

Improve your scores by practicing with handpicked questions and get detailed reports of your chapter and subject-wise performance.

Start Learning506+

Courses & Videos

265+

Expert Teacher

6.5L+

Students

310+

Live Classes Complete

Why learn on Vidyakul?

Get unlimited access to structured live batches, doubt clearing sessions, study material & practice test anytime, anywhere.

Master Batches

1000’s of courses in local languages to boost your exam preparation.

Notes + Sample Paper

Most wanted notes prepared by toppers + hand picked question.

Personal Group

While you studying, we will be with you! ask any doubts.

Mentoring

72% students forget all answered when they stressed.

Download the app